Property Investment in Leeds: Stable Demand and Long-Term Growth

Leeds continues to stand out as one of the UK’s strongest regional markets for property investment. With a thriving economy powered by finance, education, digital and professional services, the city attracts both professionals and students, creating sustained demand for quality rental housing across a range of property types.

According to recent data from Savills, property prices in Yorkshire are projected to rise by around 28.2% between 2025 and 2030, reflecting the region’s resilience and long-term growth outlook. For many investors, this makes Leeds an appealing location for steady rental income and potential capital appreciation.

At Roberts Renovations, we work with investors seeking well-structured, ethical opportunities in the Leeds property market. Our team focuses on identifying compliant, high-demand assets, from single lets to HMOs, and managing refurbishment or sourcing processes that align with each client’s investment goals.

Why Leeds is a Strong Location for Property Investment

Leeds is one of the North’s most dynamic cities, offering a strong mix of affordability, stability and long-term potential for property investors. The combination of population growth, business investment and ongoing regeneration continues to strengthen its position as a leading location for sustainable property investment.

Strong Rental Demand: Leeds attracts a varied tenant base including students, young professionals and families. This diversity supports consistent rental demand across different property types and locations.

Attractive Rental Yields: Established areas such as Headingley and Hyde Park often achieve average rental yields between 7% and 9%, providing solid income potential for landlords who prioritise well-managed, high-demand properties.

Ongoing Economic Growth: As a financial, legal and digital hub, Leeds benefits from continued investment in transport, housing and infrastructure. These improvements contribute to job creation and growing demand for quality housing.

Accessible Entry Prices: Compared to markets such as Manchester or London, Leeds offers more attainable property prices while maintaining strong rental performance. This balance appeals to both new and experienced investors seeking value and scalability.

Long-Term Growth Outlook: According to Savills, property prices in Yorkshire are expected to rise by approximately 28.2% between 2025 and 2030. This forecast highlights the region’s potential for steady capital growth supported by a resilient local economy.

.jpg)

Using Data and Tools to Select the Right Property Investment in Leeds

Investing in Leeds benefits from a data-driven approach that focuses on identifying the best-performing postcodes and long-term growth areas. At Roberts Renovations, we combine market data, historical insight, and local expertise to help investors make informed property decisions with confidence.

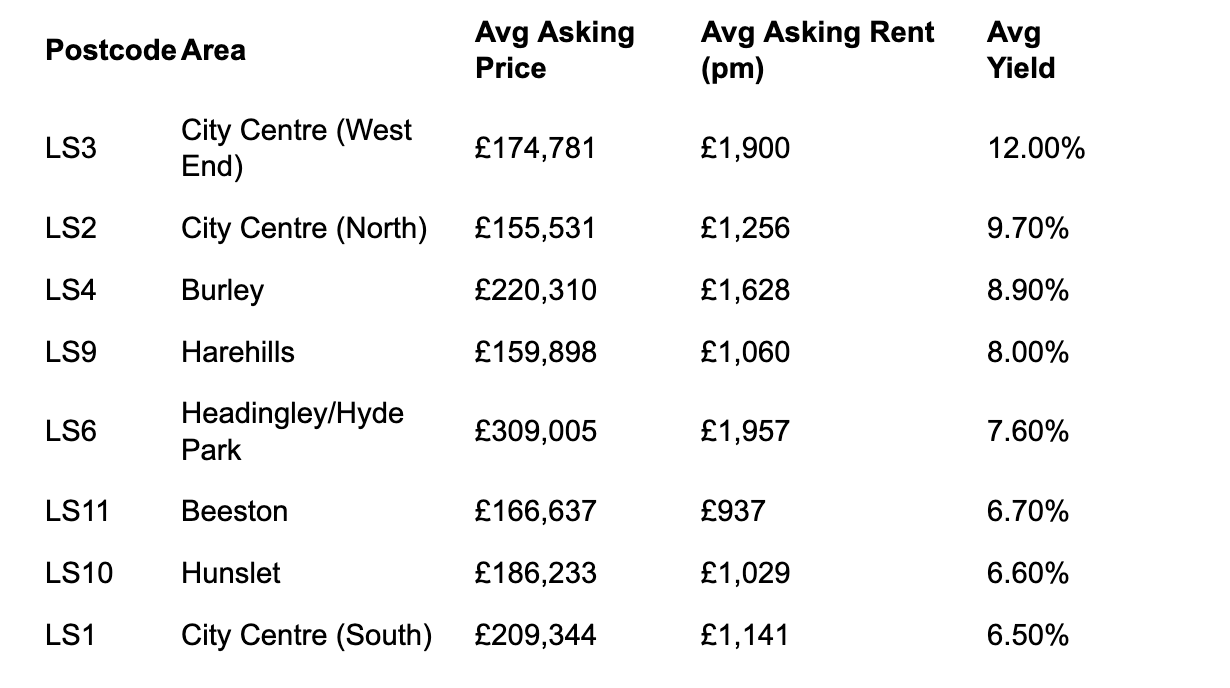

Key Insights for Leeds Investment the Data

Postcode Analysis: Understanding rental yields and average property prices by postcode is essential when identifying high-performing areas. Tools such as Property Data highlight postcode trends and yield patterns. For example, LS3 (City Centre – West End) currently records the highest rental yield at 12%, while LS6 (Headingley and Hyde Park) combines strong rental returns with long-term tenant demand.

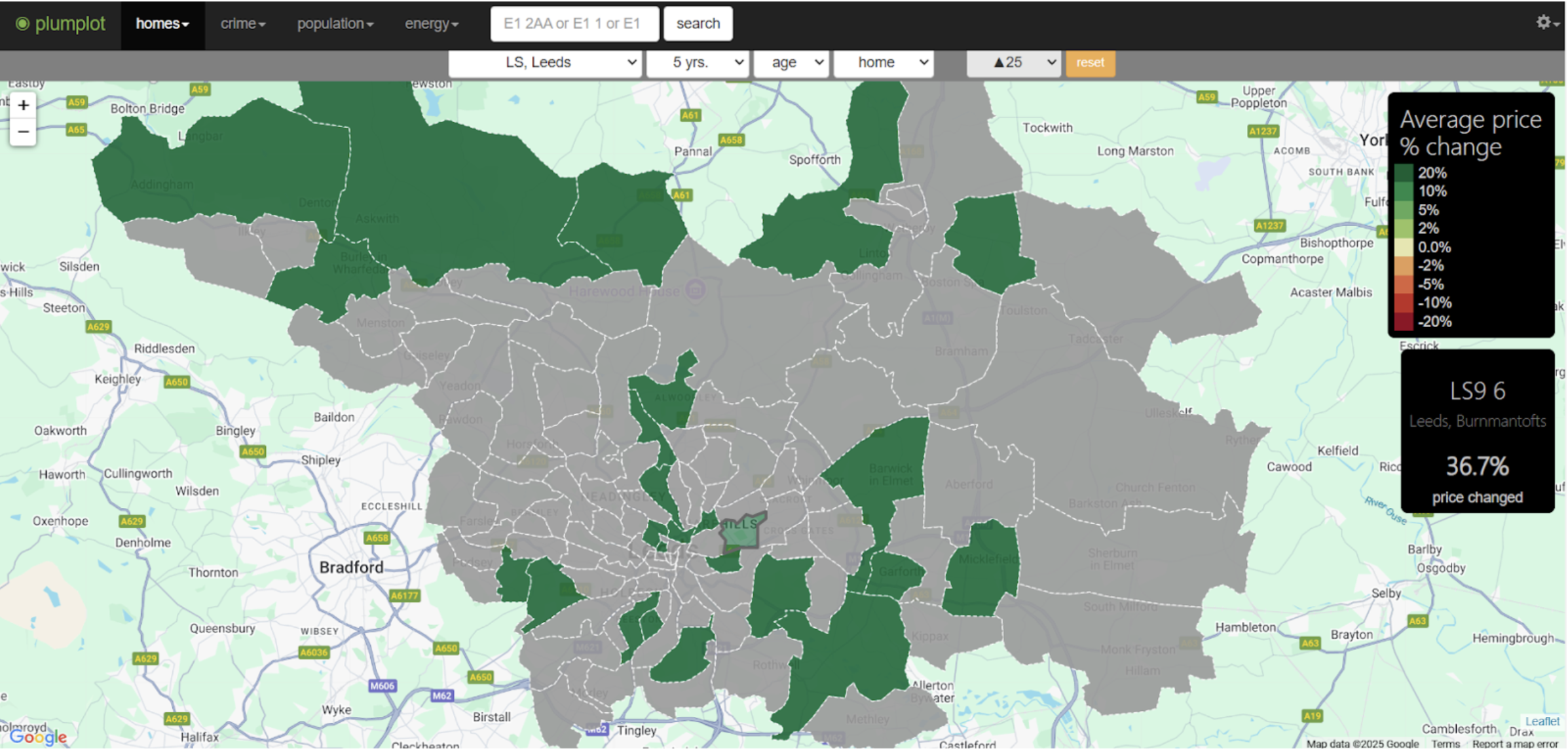

Leveraging Historical Growth: Platforms such as Plumplot provide insight into historic property price changes, helping investors assess long-term value growth. Analysing these trends can highlight postcodes with proven capital growth potential and consistent rental demand.

Best Rental Yields by Leeds Postcode

Choosing the Right Investment Model in Leeds

Leeds offers a wide range of property investment models, each suited to different financial objectives and levels of involvement. Whether focusing on cash flow, long-term growth or social impact, investors can find opportunities that align with their goals and risk profile.

HMOs (Houses in Multiple Occupation):

HMOs in areas such as Hyde Park and Burley often achieve higher rental income because rooms are rented individually. This structure can provide strong cash flow when well managed and maintained to regulatory standards.

Buy-to-Let Properties:

Buy-to-let investments in locations such as Roundhay or Chapel Allerton typically deliver steady returns and attract professionals or families seeking longer tenancies. These areas combine reliable occupancy rates with potential for gradual capital growth.

Social Housing:

Social housing investment in Leeds offers stable, long-term rental income through partnerships with housing associations or local authorities. It also supports the delivery of affordable homes, creating positive community impact alongside financial consistency.

Holiday Lets:

Short-term rentals in Leeds City Centre appeal to tourists, contractors and business travellers. When operated efficiently and within local regulations, this model can generate strong short-term returns and benefit from the city’s growing visitor economy.

Visualising Investment Opportunities in Leeds

The interactive map below highlights the top 25 areas in Leeds based on property price growth over the past five years. Each area reflects the city’s evolving property landscape, from established central districts to up-and-coming suburban zones.

Understanding these patterns helps investors identify locations showing strong historical growth and emerging potential for the future.

For a detailed overview of the Leeds property market, or to request a customised investment insights report, contact the Roberts Renovations team.

Transform your home with our property sourcing solutions

How Roberts Renovations Supports Property Investors in Leeds

At Roberts Renovations, we provide end-to-end support for property investors in Leeds, ensuring each stage of the investment process is handled with care, precision, and local expertise. Our approach combines market insight, compliance awareness, and hands-on project delivery to create sustainable, high-quality results.

Property Sourcing:

We identify high-potential properties across key Leeds postcodes, focusing on assets that align with each client’s financial objectives and preferred investment model.

Data-Driven Insights:

Using advanced tools, we analyse market data including rental yields, capital growth forecasts, and tenant demand trends. This ensures all decisions are based on reliable, up-to-date information.

Renovation and Refurbishment Management:

Our in-house team manages every stage of the renovation process, from planning and budgeting to full project delivery. We help transform properties to improve market value and long-term rental performance.

Compliance and Standards:

We ensure all projects meet local authority regulations, including HMO licensing, safety requirements, and energy efficiency standards. This provides confidence that your property is fully compliant and ready for tenants.

Lettings and Management Connections:

Through our network of trusted letting agents, we help landlords secure responsible tenants and maintain strong occupancy levels.

Legal and Financial Coordination:

We collaborate with experienced property solicitors and mortgage brokers to simplify the purchase and financing process, ensuring every transaction runs smoothly from offer to completion.

Explore Property Investment Opportunities Beyond Leeds

Leeds is one of Yorkshire’s strongest and most consistent property markets, but opportunities extend well beyond the city itself. At Roberts Renovations, we also work with investors looking for sustainable, high-demand properties across neighbouring regions.

Property Investment in York

York combines historic charm with modern tenant demand, attracting both professionals and students. The city’s steady capital growth and limited housing supply make it a popular choice for long-term investors.

Property Investment in Wakefield

Wakefield offers attractive entry prices and solid rental yields, supported by excellent transport links and ongoing regeneration projects. It’s an appealing market for investors seeking value and future growth potential.

Property Investment in Bradford

Bradford continues to benefit from major regeneration and a growing student population. Its affordability and strong rental demand create opportunities for both buy-to-let and social housing investment models.

Whether your goal is capital growth, consistent rental yield or a BRR-style strategy, our property sourcing service is designed to help you identify and secure the right opportunities across Yorkshire.

.avif)

Frequently Asked Questions

What are the best areas in Leeds for buy-to-let investments?

Areas such as Roundhay and Headingley offer strong opportunities for buy-to-let investors. Roundhay attracts professionals and families due to its green spaces and schools, while Headingley remains popular among students, supporting consistent rental demand throughout the year.

What is the average rental yield in Leeds?

According to Zoopla, the average rental yield in Leeds is approximately 6.67%, placing it among the better-performing UK cities for property investment. Yields vary by postcode, with neighbourhoods such as Hyde Park achieving returns of up to 9% based on tenant type and property condition.

How can I finance a property investment in Leeds?

Investors commonly explore financing routes such as buy-to-let mortgages, bridging finance, or refinancing existing assets to release equity. Each approach carries different costs and timelines, so independent financial advice should always be sought before proceeding.

Are there any licensing requirements for HMOs in Leeds?

Yes. All HMOs in Leeds must hold a valid licence from the local authority. Compliance includes meeting minimum room sizes, fire safety and amenity standards, and ensuring tenant rights are upheld in line with council regulations.

How can Roberts Renovations help with property management?

Roberts Renovations offers full renovation and compliance management services, along with introductions to trusted local letting agents for ongoing tenant management and property upkeep. This ensures that properties remain compliant, well-maintained, and income-generating.

What are the best property types to invest in across Leeds?

Flats, terraced houses, and HMOs are among the most popular property types for investors in Leeds. Central areas such as LS1–LS3 tend to attract young professionals and students, while suburbs like Chapel Allerton and Horsforth appeal to families and long-term renters. The right property type depends on your strategy, whether that’s consistent yield, capital growth, or renovation potential.

How does regeneration affect property prices in Leeds?

Ongoing regeneration continues to play a major role in driving property values in Leeds. Projects such as the South Bank redevelopment, Leeds Station Gateway, and the expansion of the financial district have strengthened demand for nearby housing. Investors often monitor regeneration zones as they can offer long-term growth potential once infrastructure and amenities are completed.

What is the outlook for the Leeds property market?

Leeds remains one of the UK’s most resilient regional markets. According to recent data, property prices in Yorkshire are expected to rise by around 28.2% between 2025 and 2030. The city’s mix of strong employment, infrastructure investment, and steady population growth continues to underpin confidence among landlords and investors.

Can overseas investors buy property in Leeds?

Yes, international investors can purchase property in Leeds, provided they comply with UK legal and financial requirements. This includes proof of funds, AML (Anti-Money Laundering) checks, and adherence to property ownership regulations. Professional legal and financial guidance is recommended to ensure the process runs smoothly.

How can Roberts Renovations assist investors based outside the UK?

Roberts Renovations offers remote sourcing, renovation, and management coordination for overseas investors. Our team handles the practical elements of purchasing and preparing properties in Leeds, ensuring each stage is completed to UK standards. We also work with trusted letting partners to support long-term property performance.