Property Investment in York: Long-Term Stability and Demand

York’s rich history, vibrant economy and steady population growth make it one of Yorkshire’s most attractive property investment locations. The city’s combination of consistent rental demand, strong employment sectors and limited housing supply has supported both stability and sustainable price growth.

According to a recent Savills report, property prices in Yorkshire are forecast to rise by around 28.2% between 2025 and 2030, reflecting the region’s positive long-term outlook. In York specifically, recent figures show notable five-year growth, with areas such as YO1 recording price increases of up to 74.8%, well above the regional average.

At Roberts Renovations, we work with investors to identify and manage high-quality, compliant opportunities in York’s evolving market. Through data-led analysis, local insight and full project support, we help clients access properties that balance yield potential with sustainable capital growth.

Why York is a Top City for Property Investment in Yorkshire

York offers a rare balance of heritage character and modern economic vitality, creating an environment that continues to attract investors seeking stable, long-term opportunities. The city’s blend of strong rental demand, consistent growth and cultural appeal makes it one of Yorkshire’s most reliable property markets.

Strong Rental Demand:

York’s population includes students, professionals and families, ensuring steady demand for well-maintained rental properties across the city.

Capital Growth Potential:

Property prices in York have shown exceptional resilience and upward movement. With regional values forecast to rise by around 28.2% by 2030, the city’s economy and desirability continue to support long-term appreciation.

Diverse Tenant Base:

Home to two universities and a thriving tourism sector, York attracts long-term renters, students and short-stay visitors. This variety allows investors to adopt different models, from traditional lets to short-term accommodation.

Cultural and Economic Strength:

York combines historic architecture with modern infrastructure, strong employment and excellent transport links to Leeds, Manchester and London. These attributes make it one of the UK’s most desirable cities to live and work in.

Steady Rental Yields:

The average rental yield in York is approximately 5.22%, with top-performing areas such as YO10 achieving yields of up to 8.8%. This balance of income potential and capital growth contributes to the city’s long-term investment appeal.

.jpg)

Using Data and Tools to Select the Right Property Investment in York

Investing in York benefits from a strategic, data-driven approach. At Roberts Renovations, we combine advanced analysis tools, local expertise and historical market insights to help identify well-performing areas and informed opportunities for our clients.

Key Insights from York Property Data

Postcode Analysis:

Using data platforms such as PropertyData, we help investors assess postcode-level performance. Postcodes like YO10 (Fulford) currently achieve rental yields of around 8.8%, while YO30 (Clifton) combines reliable rental income with strong long-term tenant demand.

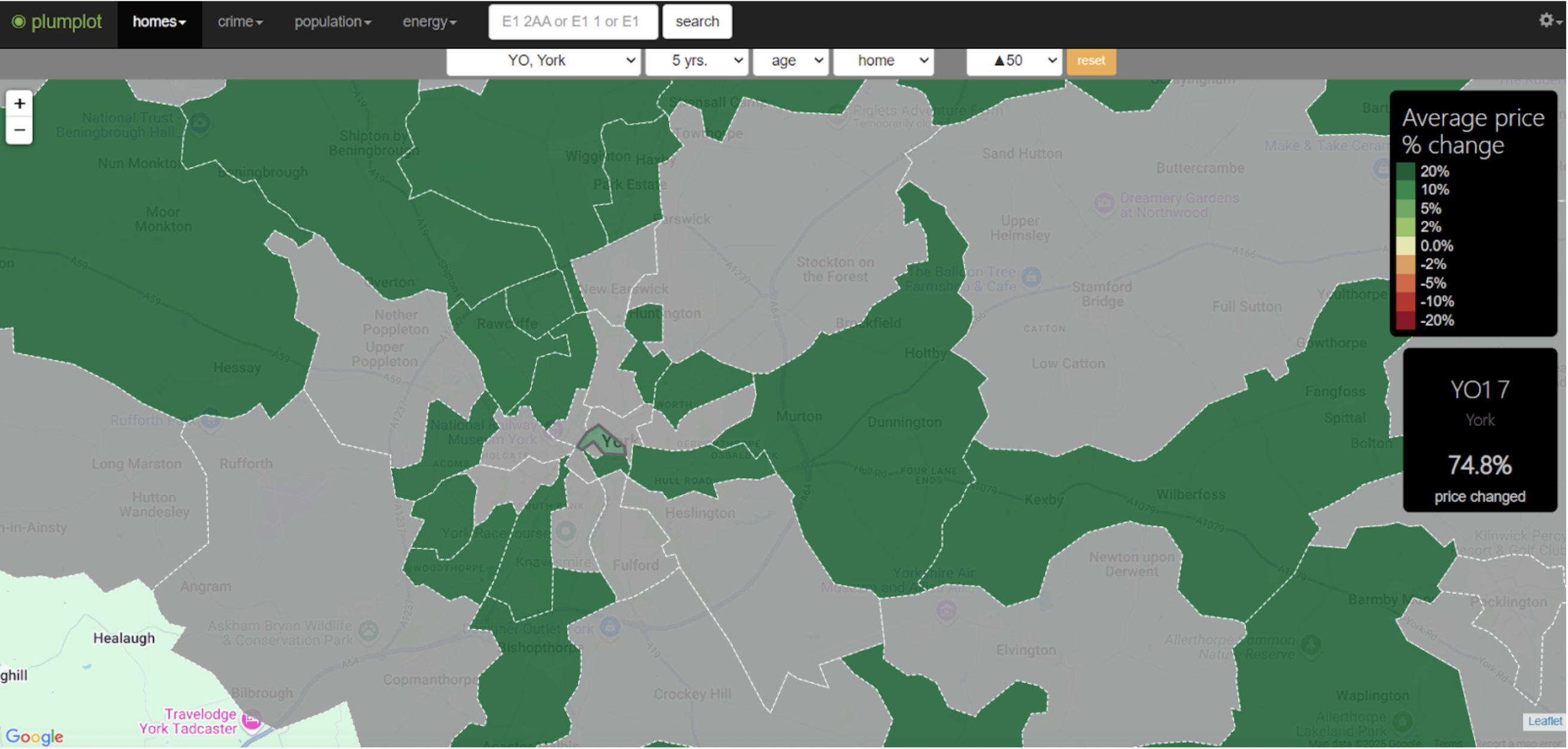

Historical Growth Trends:

Tools such as Plumplot show that York’s property values have consistently outperformed regional averages. Areas like YO1 have recorded price growth of up to 74.8% over the past five years, highlighting the city’s sustained upward trend. Analysing historic data helps investors recognise patterns and make more informed, evidence-based decisions.

Rental Yields by York Postcode

Choosing the Right Property Investment Model in York

York provides a variety of property investment models, each offering distinct advantages depending on financial objectives, time commitment, and appetite for involvement. From high-yield HMOs to long-term buy-to-lets, the city caters to a wide range of investor strategies.

HMOs (Houses in Multiple Occupation):

In postcodes such as YO10 (Fulford and Heslington), HMOs often achieve higher rental income because rooms are let individually. When managed effectively and maintained to regulation standards, this model can provide strong and consistent cash flow.

Buy-to-Let Properties:

Buy-to-let investments in areas such as YO31 (Heworth) deliver steady returns and attract families and professionals looking for quality homes close to the city centre. These locations combine reliable occupancy rates with stable long-term growth potential.

Social Housing:

Social housing investment in York offers secure, long-term rental income through agreements with housing associations or local councils. This model appeals to investors focused on stable returns and positive community outcomes.

Holiday Lets:

York’s city centre (YO1) continues to see strong demand from tourists, business travellers and short-stay visitors. Well-managed holiday rentals in this area can generate competitive short-term income and benefit from the city’s year-round tourism economy.

Visualising Property Investment Opportunities in York

The map below highlights the top 25 areas in York based on property price growth over the past five years. This data reveals which postcodes have seen the strongest performance, helping investors understand how different areas have evolved and where future opportunities may lie.

For a detailed analysis of York’s property market, or to request a customised investment insights report, contact the Roberts Renovations team.

Transform your home with our property sourcing solutions

How Roberts Renovations Supports Property Investors in York

At Roberts Renovations, we provide comprehensive, end-to-end support for property investors in York. Our approach combines local expertise, data-led insights and project management experience to ensure every stage of your investment is handled professionally and transparently.

Property Sourcing:

We identify high-potential properties across York’s key postcodes, focusing on opportunities that align with your budget, strategy and long-term objectives.

Data-Driven Insights:

Using advanced analytical tools, we provide detailed market intelligence, including rental yield trends, property value growth and area-specific tenant demand.

Renovation and Refurbishment Management:

Our specialist team manages every aspect of renovation work, from planning and budgeting through to delivery. We help enhance property value, improve compliance and increase rental appeal.

Compliance and Standards:

We ensure all properties meet York’s local authority requirements, including HMO licensing, energy efficiency and fire safety regulations. This gives investors confidence that every property is compliant and ready for tenants.

Lettings and Management Connections:

Through our network of trusted letting agents, we help investors maintain high occupancy levels and support long-term portfolio performance.

Legal and Financial Coordination:

We work closely with experienced solicitors and mortgage brokers to simplify the purchase process and ensure transactions proceed smoothly from offer to completion.

Invest in Property in York or Explore Other Yorkshire Locations

Thinking about investing in York? Let’s talk. At Roberts Renovations, we combine local knowledge, transparent communication and specialist property sourcing to help investors make informed decisions with confidence.

While you’re here, why not explore some of the other Yorkshire areas we cover? Each location offers its own opportunities for growth and consistent rental demand.

Explore other Yorkshire investment locations:

Ready to invest in York?

Contact Roberts Renovations today for expert guidance and tailored solutions to help you achieve your property investment goals.

.avif)

Frequently Asked Questions

What are the best areas in York for buy-to-let investments?

Areas such as YO10 (Fulford) and YO31 (Heworth) offer excellent opportunities for buy-to-let investors. Fulford attracts students and young professionals, while Heworth appeals to families looking for longer-term rental homes, helping maintain consistent tenant demand.

What is the average rental yield in York?

According to Zoopla, the average rental yield in York is around 5.22%. Top-performing postcodes such as YO10 achieve yields of up to 8.8%, supported by strong tenant demand and limited local housing supply.

Are holiday lets a good investment in York?

Yes. York City Centre (YO1) is a popular area for short-term rentals, attracting both tourists and business travellers year-round. When managed efficiently and in line with local regulations, holiday lets in York can deliver competitive short-term rental income.

What tools can help assess York’s property market?

Tools such as PropertyData and Plumplot provide detailed insights into historic price growth, average rental yields and local tenant demand. Using this data helps investors make well-informed, evidence-based decisions.

How can Roberts Renovations support my investment journey?

Roberts Renovations provides tailored support across the full property investment process, including sourcing, renovation management, compliance guidance and introductions to trusted letting and legal professionals.

What are the licensing requirements for HMOs in York?

All Houses in Multiple Occupation (HMOs) in York must be licensed by the City of York Council. Licensing ensures properties meet essential safety, space, and facility standards. Landlords must also comply with fire safety regulations and provide adequate amenities for tenants. Local authority guidance should always be reviewed before letting a property as an HMO.

Can overseas investors buy property in York?

Yes. Overseas investors can purchase property in York, provided they meet UK legal and financial requirements. This includes Anti-Money Laundering (AML) checks and proof of funds. Professional legal and financial advice is recommended to ensure the process runs smoothly and complies with UK property regulations.

What is the outlook for the York property market?

York continues to show steady long-term growth supported by limited housing supply, strong tenant demand, and a resilient local economy. According to regional forecasts from Savills, Yorkshire property prices are expected to rise by around 28.2% between 2025 and 2030. For York, areas such as YO1 and YO10 have already recorded strong five-year growth, highlighting sustained market confidence.

What types of property perform best for investors in York?

Flats and family homes near the city centre and university areas remain popular with both long-term renters and short-term tenants. Investors seeking consistent income often focus on buy-to-lets and HMOs in areas such as Heworth and Fulford, while those targeting capital growth may prefer city-centre or regeneration zones.

How does regeneration impact property values in York?

Ongoing investment in transport, housing and local infrastructure continues to support property value growth across York. Projects improving connectivity and amenities help attract both residents and businesses, increasing demand for quality rental homes. Investors monitoring these regeneration zones often find strong long-term potential.

How can Roberts Renovations assist overseas or remote investors?

Roberts Renovations provides a fully managed service for investors based outside York or overseas. We handle property sourcing, renovation management, and local compliance, while coordinating with trusted letting agents and legal professionals to ensure every stage of the process is completed efficiently.